All Covip articles

-

News

NewsItalian investors grapple with ban on controversial weapons investments

Pension regulator COVIP, Bank of Italy, IVASS, and the Ministry of Finance published guidelines but no exclusion list

-

News

NewsCONSOB committee pushes to force Italian schemes to invest in SMEs’ equities

Italian pension funds only invest 1.8% of total assets in equities of domestic companies, according to pensions regulator COVIP

-

News

NewsItaly’s complementary pension schemes records 8.2% assets growth

Assets under management for complementary pension schemes in Italy increased to €243bn in 2024

-

News

NewsItalian pension funds call for action to boost pension membership

Assofondipensione proposes new ‘silent consent’ mechanism

-

News

NewsFondenergia picks UBS AM to invest sub-funds assets

Credit Suisse Italy is replaced by UBS AM in Garantito’ sub-fund and government bonds (excl euro) in its ‘Bilanciato’ sub-fund

-

News

NewsAUM of Italy’s first pillar schemes shoots up by 10%

Over the last 10 years, the AUM volume of Italian pension schemes has grown by €48.4bn, according to Covip

-

News

NewsIntesa Sanpaolo, Cariplo pension funds merge to create €12bn scheme

The integration will take place through a ‘collective transfer’ of members and accrued savings

-

Analysis

AnalysisItaly’s plan to divert severance payments to pension funds stirs up concerns

It is essential to understand the impact of the measure because a mandatory option is being introduced in a system based on voluntary access, says Assofondipensione

-

News

NewsItaly’s complementary pension schemes record 8% contribution growth in H1

The number of members signing up for complementary pensions at the end of June 2024 grew by 2.3% to 10.9 million

-

Country Report

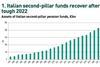

Country ReportSlow growth for Italy's second-pillar pensions

Despite the urgency of increasing second-pillar coverage, policymakers continue to focus reform efforts on public pensions

-

News

NewsItaly’s pension regulator recommends tweaks to complementary pension system

COVIP is calling for adjustments to the complementary pension system to attract potential new members

-

News

NewsReal economy investment opportunity ‘remains large’ for pension funds, says COVIP

There is increasing interest by Italian schemes to invest in the country’s real economy, as they expand their investment strategies through partnerships

-

News

NewsCometa proposes FoF with protection mechanism for direct investments in Italy

the fund is ready to pilot a project with Cassa Depositi e Prestiti to channel capital to support the real economy

-

News

NewsItalian pension schemes with higher equity exposure outperform, says COVIP

Laborfonds, Fondaereo, and Fopen’s equity sub-funds recorded higher returns in 2023 than peers investing in other asset classes

-

News

NewsItalian parliamentary committee to investigate schemes’ investment policies

The investigations aim to understand ongoing challenges posed by Italy’s aging population, the green transition, the changing labour market and macroeconomic environment

-

News

NewsItalian pension funds see number of members increase in Q3

Industry-wide pension funds added 188,000 members so far this year, compared with the end of 2022, a 4.9% increase, for a total of almost 4 million members

-

News

NewsInarcassa’s new strategy sees cuts to equity in favour of bonds, infrastructure

Assets under management for first-pillar pension schemes, according to pension regulator Covip

-

News

NewsItalian pension funds recover with AUM reaching €214bn in H1

Pension schemes recorded overall positive returns in the first six months of 2023, but results were up particularly for those with higher exposure to equity investment

-

News

NewsItalian government readies new investment rules for first pillar pension system

Pension schemes have been waiting for an upgrade to their investment rules since 2011

-

News

NewsItalian pension funds lean towards domestic investments, says COVIP

Many pension funds are also expanding their investment strategies in private equity and private debt, according to the pensions regulator